A lot of economic events had a remarkable impact on major currencies during the day, the beginning was when the Euro boosted its gains when the U.S President Donald Trump disclosed highly classified information to Russia's foreign minister about a planned Islamic State operation. Besides the disappointed data from the U.S economy last week and the doubt over Trump’s economic policy.

Political turmoil relatively has calm down in the Euro-zone, especially after Macron’s winning in the French presidential elections. Today Eurostat released GDP data and it showed growing in the first quarter of 2017 by 0.5%.

In the UK, despite the positive data of inflation numbers, the pound didn’t react positively and fall by 90 pips against US dollars. The CPI printed the highest reading in three years at 2.7%, and with this continuous rising in inflation numbers and exceeding BOE inflation report expectations could push monetary policy committee to move forward rising rates before this year ended.

In the US, housing market data showed some possibility of weakness in the coming quarter, as housing starts indicator printed lowest reading since last November by 2.6% with 1.17 m unit in April, while building permits declined by 2.5% to 1.23m in April.

Moving to Japan, Kuroda left the door opened for more Procedures, if inflation didn’t reach the target at 2%, in the same time, he confirmed on that BOJ has enough tools to end stimulus program in the suitable time.

Earlier this morning, the RBA expressed concern on continues rising in housing markets, and confirmed on its current mandate on accommodative policy with leaving rates as it is at 1.50% maybe till the end of this year.

Oil managed to keep up its gains from last days, after news about extending output cuts agreement between Russia & Saudi Arabia maybe till the first quarter of 2018. US Crude oil was stable during today at levels of 49$, while Brent crude gained by 9% the week reaching levels of 52$.

Technically :

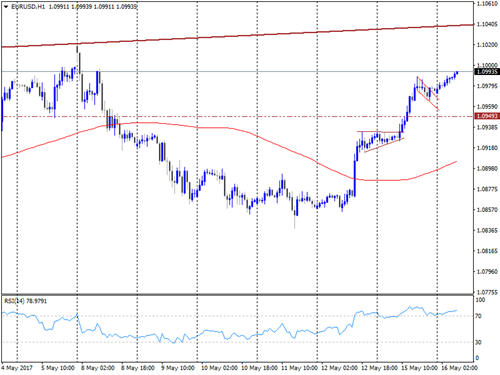

EURUSD

The pair has risen sharply today exceeding the upper limit of ascending channel and resistance level at 1.1040, and printed the highest level in six months at 1.1088. prices are targeting now next resistance levels at 1.1126 then 1.13. it could pull back from these resistance to test 1.1040 before continuing rising.

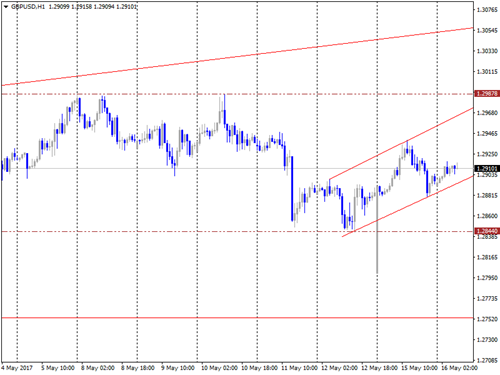

GBPUSD

The pair has risen with the beginning of trading day till levels of 1.2932, but it pulled back quickly till 1.2865, we noticed currently prices are forming head & shoulders pattern will be completed with breaking down support level at 1.2842, targeting 1.2710. current resistance will be 1.2960 the 1.2990.

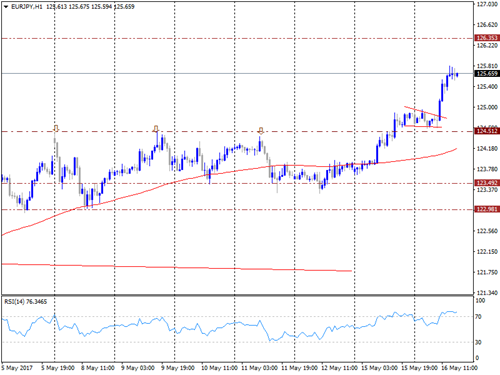

EURJPY

The pair managed to keep up higher the broken resistance at 124.50, reaching levels of 125.80, current resistance will be at 126.35, we expect further rising till levels of 128.30 if breaks current resistance, we could see prices pulled back testing strong support at 124.50 before rising again.