We’re here to help

About Equiti FAQs

Who is Equiti?

Equiti Securities Currencies Brokers LLC is a multi-asset spot forex & OTC broker and the GCC entity of Equiti Group Ltd. We offer trading access to global markets on MetaTrader 4 & 5 with constantly expanding financial products from various sectors – like forex, indices, shares, commodities, futures, ETFs and crypto CFDs.

Equiti Group Ltd is a global company comprised of prime brokerage providers and progressive multi-asset entities across 6 regions. We provide clients with access to individual, corporate and institutional services driven by pioneering fintech.

Our global footprint includes local offices in the Middle East, North America, Europe and the Asia Pacific regions.

What type of broker is Equiti?

We are a mark-to-market straight through processing (or ‘STP’) execution-only broker, licensed and regulated by the United Arab Emirates Securities and Commodities Authority (SCA). This means we do not take risk against our clients - all positions are sent directly to our liquidity providers.

Where do we get our pricing from?

Our deep liquidity pool connects our clients to more than 35 liquidity providers including over 20 Tier 1 Banks and prime brokers.

Is Equiti a regulated broker?

Equiti Securities Currencies Broker LLC (a subsidiary of Equiti Group) is a multi-asset broker fully authorised and regulated by the Securities and Commodities Authority (SCA) of the United Arab Emirates.

SCA is a legal entity, which is financially and administratively independent, reporting directly to the Minister of Economy in the UAE. The main objective of SCA is to supervise and monitor financial markets.

Where are our offices located?

Find us in Dubai at Office 201, Lamborghini Dubai Building, Sheikh Zayed Rd, Umm Al Sheif, Dubai UAE (PO Box 117814).

You can also find our office using GoogleMap coordinates ‘25.128696, 55.208408’ or What3Words: ///inspected.brokered.majestically.

Can I visit your office?

We’d be happy to welcome you. Please arrange a visit to our office by scheduling an appointment with one of our team members. You can call (+971) 4436-8301 or email support.ae@equiti.com to reach us in Dubai.

General trading FAQs

What is online trading?

Online trading generally refers to buying and selling OTC securities (or ‘trading instruments’) via the Internet or other electronic means - such as wireless access or touch-tone telephones. In most cases, customers access a brokerage firm's Client Portal (or website) through their regular Internet Service Provider. Once there, customers may consult provided information, monitor activity and place or close orders by logging into their personal, secure accounts.

Is trading only for professional traders?

Anyone from any background can trade online – all that’s required is a verified bank account and sufficient funds for starting to place trades. We support all levels of traders with tiered accounts, dedicated managers, multilingual customer support and competitive pricing.

What is a ‘stop loss’ order & why should I use it?

Arguably the most popular tool for reducing risk, stop-loss orders are designed to limit loss on a security position that’s made an unfavourable move. When you place a stop-loss order with a broker, you’re requesting to close the position once the instrument reaches a certain price. This is helpful as it means your trades need less monitoring and can help to limit losses, particularly in volatile markets.

Please also note that a stop loss is by no means a guarantee, positions may be affected by price gaps over market closures, data release or other economic factors.

How can I make the most profit?

Trading CFDs is based on the speculation that the value of one asset will increase relative to another, which creates potential to maximise profit but there’s no guaranteed strategy or market that will always deliver profits. If your current broker says otherwise, check if they’re regulated!

Investing in global markets by purchasing forex, commodities, ETFs or other CFD products will free up your capital and give you the opportunity to profit - but we always encourage our clients to risk only what they can afford to lose. Markets are known to be unpredictable which means both losses and profits can equally increase.

What are spreads?

Spreads are measured in pips and show the difference between buy and sell price. In trading, ‘ask price’ (or ‘offer price’) means the price you’d like to buy at, and ‘bid price’ is what you’d like to sell at. In practice, if EURUSD has a bid price of 1.55310 and an ask price of 1.55313, the spread would be 0.3 pips.

What is a ‘pip’?

A pip, short for ‘point in percentage’, is a very small measure of change in a currency pair in the forex market. It can be measured in terms of the quote or the underlying currency. A pip is a standardised unit for the smallest amount by which a currency quote can change. It is usually $0.0001 for USD-related currency pairs. A fractional pip or point is equivalent to 1/10 of a pip. There are 10 points to every 1 pip.

What is a trading ‘lot’?

The basic contract unit of the Retail Foreign Exchange is called a ‘lot’.

The standard lot size is 100,000 units of the base currency (1st currency in the currency pair), however you can also trade multiples or fractions of lots. The minimum at Equiti is 0.01 lot.

Example: Buying 1 lot on the GBP/USD market is the equivalent to buying £100,000 and selling the equivalent amount of USD at the current rate.

Lot Size Units of base currency (First currency)

1 100,000

0.1 10,000

0.01 1,000

What is ‘leverage’ & how do I use it?

We offer leverage through the use of margins, where we provide borrowed funds from our deep liquidity pool to increase your trading position. This means traders can increase their market exposure by paying a fraction of the initial investment. In practice, 1:20 leverage means you can invest $10 and trade with $200 - allowing for higher potential gains AND losses. Make sure you understand your risk appetite. Try to minimise your losses by using stop loss tools or other risk management strategies.

We offer up to 1:400 leverage on selected products including precious metals, gold, oil & natural gas commodity CFDs.

What are CFDs & how do I trade them?

CFDs or ‘contracts for difference’ are derivative products designed so that you can trade on the price change of an underlying asset.

This means you can trade on the price movements or performance of assets without needing to own them outright - which allows you to go long or short and potentially benefit from either rising or falling markets.

Start trading commodity CFDs

You can also trade CFD indices such as the US500, UK100, AUS200, China50 & Sing30.

Start trading index CFDs

What’s the main difference between CFDs and forex?

CFD (or ‘contracts for difference’) trading involves different types of contracts covering a diverse set of financial instruments such as indices & commodities - whereas forex refers to pure currency pair trading.

Another way of looking at it is that forex is mostly driven by global events & CFDs are mostly impacted by the supply/demand of the performance of underlying instruments. However, all instruments will be affected by multiple factors and can also be impacted by unprecedented events. There is no fixed guide to trading, so we always recommend to seek independent advice and to keep a close eye on all your open trades.

Is my personal information safe?

Yes, we take every precaution to ensure the security & privacy of our client’s private data. We guarantee to keep all personal information highly secured – we do not pass your personal information to any third party, and we do not sell your personal information for any purposes.

We are compliant with UAE regulations and guarantee to fulfil our data protection obligations in regards to your personal data security.

What are forex trading hours?

The Forex market is open almost 24 hours a day, 5 days a week - with a small trading break over rollover.

The time on MT4 is shown as Eastern European Time (EET).

During Daylight-Saving Time, EET is 3 hours ahead of Greenwich Mean Time (GMT +3). During Standard (Winter) Time, EET is 2 hours ahead of GMT (GMT +2).

The end of our trading day always aligns with the market close in New York.

What are precious metal trading hours?

Precious metals operate on similar trading hours to forex with the additional daily break at 21.00-22.00 GMT during BST (British Summer Time) and 22.00-23.00 during GMT DST (Daylight Saving Time).

Can I trade outside of trading hours?

Unfortunately, no. Trades can only be placed during open market hours – but the markets will continue to evolve 24/7. Some traders prefer to use stop loss orders to minimise risk, to always check rolling fees & to contract expiry dates before placing a trade to ensure they run as planned.

Do you allow scalping & hedging?

Yes, we do. At Equiti, we welcome any trading strategies that are in line with SCA’s regulations and our internal terms & conditions.

What is a required margin?

The margin requirement is the amount of funds needed to hold a position open.

Read our legal documentation

Do you offer margin-free hedging?

Yes, we offer margin-free hedging where any hedged positions are set to ‘zero’. This means you do not need a margin to maintain the position which will be your net position equal to zero. This allows you to benefit from more available funds, but it can also pose the risk of triggering ‘margin call’ or ‘stop out' events when sudden spread widening (eg. during news releases).

Please consider rolling fees over weekends in your financial planning as margin-free hedged positions are not swap-free - unless you are trading on a swap-free account.

What is the margin requirement for hedged positions?

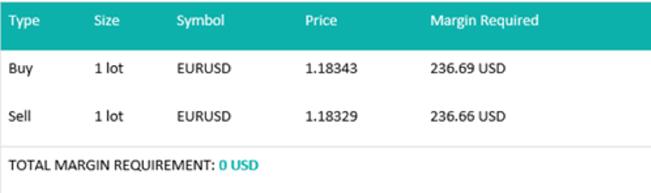

Our margin requirement for hedged positions is ‘zero’.

When you decide to hedge a position in one particular instrument (respectively buying or selling the same amount of that instrument), there will not be any margin needed to maintain the hedged position. As such, your net position will be equal to zero.

As a result of the decreased margin, you will have the benefit of more available funds.

Example:

Margin-free hedging however can also pose a risk of triggering either “Margin Call” or “Stop Out” events - such as if one of the positions is closed and the other requires a margin that equals or exceeds the one available for trading, or in the case where a spread widening might occur that affects your equity negatively and increases your losses.

If the required margin for hedged positions is 0, how can my positions be stopped out?

While there is no margin requirement requested for fully hedged positions, this does not protect your orders to be closed out at one point.

Mainly this is related to spread widening. Spreads may widen depending on the product you are trading during overnight hours, over news releases or during market opening and market closure (as liquidity is thin & volatility is high).

This can also be related to the overnight financial charges, which apply to each position if you keep them open over rollover, which takes place at midnight MT4 platform time each trading day.

The moment the equity on your account falls below zero your open positions will be closed out - so it is important to ensure you have funds to support your account.

Are my trades guaranteed?

No, there is never a guarantee in trading. We will always to our best to place your orders, but when trading with high volatility prices may change and we may not be able to obtain a quote at the initially requested price as per best practices in the industry.

Can I lose more than I deposited?

Yes, all trades offer the chance for profits or losses. As per industry best practices, we operate a stop-out system. This means that if the equity on your account falls below 30% of the required margin for the open position, the system will be instructed to start closing out positions, beginning with the position making the greatest loss. The cost of trading is cumulative, so you must have enough funds to support all of your open positions or you may be stopped out.

However, the forex market is highly volatile and if you have a very low margin level at the time of economic news releases (or under other abnormal conditions), the market can rapidly move against you and the system will close open positions at the next best available price, which could cause you to lose the whole deposit or even more.

If you are holding positions over a weekend when we are closed, the market can open out-of-line from the close on Friday, which can also cause extended losses.

Account FAQs

What does it cost to open an Equiti account?

We don’t charge a cent. When you trade with Equiti, 100% of your deposit will go into your trading account - but please be aware that your personal bank may charge you for wire transfers when making deposits.

At Equiti, we keep our pricing transparent and charge low-to-zero commission (depending on account type) because our mission is to make financial markets accessible worldwide.

How do I open a live account?

Apply for an account by submitting your contact details, personal information (with proof of address), bank statement & trading experience. Once the application is complete & all appropriateness checks are valid, we’ll email you access codes to our client portal. Upon opening the portal with your unique details, you’ll be able to make your first deposit via secure transfer along with your proof of account.

Compare Standard & Premier accounts

Can I open a Demo account?

Yes, you can open a free Demo account with a balance of $10,000 in simulated funds to test the platform and your trading strategies on live markets in a risk-free environment.

Open a Demo account

Will my Demo account expire?

Yes, all Demo accounts expire if inactive for 90 days.

What’s the right trading account for me?

Finding the right account type for your trading needs depends on your experience and deposit size. Open a Standard account with deposits from $0 to enjoy zero commission. Premier accounts with deposits from $3,000 offer super-tight spreads from 0.0 pips*. If you’re not ready to fund, practice risk-free on real markets with a Demo account.

Can someone trade on my behalf?

Equiti is an execution-only broker. That means we do not trade on behalf of its clients, nor does it recommend anyone to trade on behalf of clients.

However, you can, at your own discretion and liability, appoint someone else to trade on your behalf by providing a signed limited power of attorney subject to our compliance team’s approval. If you wish to appoint an asset manager, we will need to verify that they are regulated and licensed to do so.

Can I change my existing account type or currency?

Once an account type & currency is set, it’s not possible to change these details to ensure we stay compliant to local regulators. We do allow up to five trading accounts under any one portal, so we recommend you open a second (or fifth – at the max) account with a new account type and currency.

Can I open more than one trading account?

Yes, you can have a maximum of 5 live trading accounts with Equiti.

Open an additional account in 5 simple steps:

- Login to your client portal

- Click on ‘Add Account’

- Select ‘Live Account’

- Choose the type, currency and reason for your new account

- Enter your password and click ‘submit’

Once approved, your new trading account login credentials will be sent via email.

Can I open more than one Demo account?

Yes, you can have an unlimited amount of Demo accounts through your client portal.

Can I open a swap-free account?

Yes, we offer swap-free accounts which are exempted from swaps on currency majors, minors & precious metals. It is not possible to have a swap-free and swap-enabled account open at the same time, but you can convert your existing account to swap-free by contacting our dedicated account managers.

Please make sure to check all products within a swap-free account as in certain cases, like exotic currency pairs, rolling indices or commodities - some swap charges may still apply. For products that have a fixed expiry date, like futures CFDs or rolling CFDs, a fixed commission of $10/lot is applied.

Read full terms & conditions

Do you offer corporate accounts?

Yes, we do offer corporate accounts. Please contact us at support.ae@equiti.com for further information on the corporate account opening process.

What documents do I need to open a live account?

Typical documents that are requested for individual retail applications are a proof of identity (i.e., valid passport), proof of address (i.e. rental contract, utility bill, etc.) & proof of account (i.e. bank statements, etc.).

Document requests may vary depending on the type of application you are applying for and your country of residence, so you might be requested for additional documents by our account opening team.

What is the difference between a ‘landing/wallet’ account and a trading account?

A Landing/Wallet Account is similar to an E-Wallet. When you fund your account, your funds will be deposited to the Landing Account in that currency. You can have 4 Landing Accounts (one for each account currency: USD, EUR, GBP and AED).

You cannot log in to the MT4 with your Landing Account, you must use your Trading Account to do so. A Trading Account allows you to trade on the MT4 platform & can be in any one of the following currencies (USD, EUR, GBP and AED). To start trading, you will need to make an internal transfer from your Landing Account to your Trading Account.

The same applies when you would like to make a withdrawal, you will need to transfer your funds from your Trading Account to your Landing Account in order to proceed. You cannot make a withdrawal directly from your Trading Account.

Do you offer micro-accounts (Penny Accounts)?

We do not offer micro-accounts but our Standard & Premier accounts allow a minimum traded volume of 0.01 standard lots to open a position.

What is the order execution technology on my account?

All accounts have ECN market execution technology. Equiti Currencies Securities Brokers LLC are a mark-to-market straight-through processing (or ‘STP’) execution-only broker, licensed and regulated by the United Arab Emirates Securities and Commodities Authority (SCA). This means we do not hold the clients’ positions, all positions are sent directly to our liquidity providers.

Financing FAQs

How do I fund my account & where will my money go?

All deposits can be made via secure bank transfer and Debit/Credit cards on our client portal. For your first deposit, we’ll request you verify your account deposit. Once deposits have been received, your funds will be kept in segregated accounts with global, secure banks for added tiers of security. All future deposits made by the same account and method will be instant.

What currencies can I use to deposit & withdraw funds?

Supported currencies for deposits and withdrawals are AED, USD, GBP and EUR.

What fees will I be charged for making a deposit?

We do not charge any fees for making a deposit, but your bank or payment solution might charge you for transfers made. Equiti is not liable for any charges that may apply.

Can someone else deposit into my account?

As we adhere strictly to local laws and procedures, we do not accept or process third-party payments (including family members).

If you have further questions, either scroll down to read our payment FAQs or contact our friendly team.

You can call (+971) 4436-8301 or email support.ae@equiti.com to reach us in Dubai.

How do I withdraw my funds?

Request to withdraw your funds directly from our client portal. All withdrawal requests are processed daily by our team. Requests received before 11:00 AM GMT or 15:00 PM GST on a business day may be processed within the same day, any requests received after this time are processed on a ‘best endeavours’ basis.

How can I deposit funds?

You can make a deposit into your Wallet account via secure bank transfer and Debit/Credit card either online through the Client Portal or by visiting one of your bank’s branches.

To make a deposit online; open your Client Portal, select ‘Deposits’ on the left side panel, click ‘Bank Transfer’ and read through the wiring instructions to our bank accounts. Each account is linked to a specific currency (AED, USD, GBP or EUR) and you should choose the currency best fitted to your Trading Account.

Kindly note that any other currency may need to be exchanged at the current rate of the transfer - although we do not charge any fees for deposits, your bank may charge you to make a transfer.

Deposit times vary depending on the source of the transfer. Internal transfers (within the same bank) are instant, but domestic (1-3 working days) & international (1-5 working days) wire transfers may take longer.

For further detail, kindly scroll down to the bottom of the page to download our Legal Documentation on ‘Payment Terms & Conditions’.

Where will my withdrawn funds go?

Withdrawals are returned to the source of original payment. If Equiti is unable to do this, then we will return the funds directly to your bank account. This will be done in line with our strict anti-money-laundering and counter-terrorism financing Local Laws and procedures and may include you having to provide additional identification and proof the bank account belongs to you.

What do rollover costs mean?

The financing cost for your CFD trade is referred to as ‘rollover.' This is the interest paid depending on the size of the position and for holding a position at 23:59 server time (server time is New York time). For index CFDs, any dividend adjustments issued are included in the rollover amount as well.

The formula for financing costs (for a product such as indices) is as follows:

Closing Price of the Index * the interest rate / 100 / Number of Days +/- Dividends * Trade Size

Pay attention to open positions on Fridays. If you hold a position over the weekend on rolling commodities or indices, the rollover is 3 times as you’ll be unable to close a position until the markets open on Monday AM. When trading forex, most 3 rolls will be charged on Wednesdays, however some exceptions may apply.

To avoid rollover charges, make sure to close any open positions before 23:59 server time (server time is New York time).

To see all calculation examples, please refer to our Financing Fees page.

What are rollover rates or swap fees used for?

The rollover rate (or ‘swap fee/rate’) is the cost of holding a currency pair overnight - it is the rate at which interest in one currency will be exchanged for interest in another currency—that is, a swap rate is the interest rate differential between the traded forex pair.

This is important when you still have open positions by 17:00 EST (21:00 GMT) on a trading day, as it will be ‘held overnight’ and charged a swap fee/rate (or ‘rollover fee/rate’) that’s specific to the margin or product you’re trading on.

How do I calculate costs for Entry & Exit?

Here’s a few scenarios to help you understand how to calculate entry & exit costs. Let’s use a ‘USOIL scenario’ where we assume that the initial deposit is USD$1,500 & the trading account currency is USD. The leverage is ‘1:100’, the initial margin required is USD$57, the nominal value of the position is 1000 barrels (100 Lots) & the spread is 3.6 pips.

- Favourable Scenario: Client buys 100 lots of USOil at 57.018 (ASK) and the market moves up 33.6 pips within two hours. The client decides to close out their position at 57.318 (BID) which creates a profit of USD$300.

- Moderate Positive Scenario: Client buys 100 lots of USOil at 57.018 (ASK) and the market moves up 16.8 pips within two hours. The client decides to close out their position at 57.150 (BID) which creates a profit of USD$132.

- Moderate Negative Scenario: Client buys 100 lots of USOil at 57.018 (ASK) and the market moves down 16.8 pips within two hours. The client decides to close out their position at 56.814 (BID) which creates a loss of USD$204.

- Unfavourable Scenario: Client buys 100 lots of USOil at 57.018 (ASK) and the market moves down 33.6 pips within two hours. The client decides to close out their position at 56.646 (BID) which creates a loss of USD$372.

- Stress Scenario: Client buys 100 lots of USOil at 57.018 (ASK) and the market moves down 185.0 pips within two hours. The position is stopped out and the system closes out their position at 55.132 (BID) creating a loss of USD$1,886.

Platform FAQs

What platforms do you offer?

We offer MetaTrader 4 (MT4) and MetaTrader 5 (MT5) access which allows traders to access financial markets on mobile, tablet and laptop - so you can trade from the office, a taxi or even your own breakfast table. Both MT4 and MT5 offer customisable charts, flexible strategies, and a unique dashboard with Expert Advisor tools that allow you to test your strategies or/and enable automated trading.

Compare Trading Platforms

What is MetaTrader 4?

MetaTrader 4 is a trading platform developed by MetaQuotes Software for online trading in forex, contract for differences (CFDs) and futures markets.

MT4 provides tools and resources that allow traders to analyse price & place, to manage trades and to employ automated trading techniques.

What is MetaTrader 5?

MetaTrader 5 is a trading platform developed by MetaQuotes Software for online trading in forex, contract for differences (CFDs) and futures markets.

MT5 provides tools and resources that allow traders to analyse price & place, to manage trades and to employ automated trading techniques.

How do I download the MT4 platform?

Open a Demo or live trading account with Equiti to access MT4 on our client portal. Once your account is verified, we’ll email you a link to start the installation process that will enable you to trade on any device.

How do I login to MT4?

Open MT4 & enter your Equiti account details in the authorisation login box. If it hasn’t popped up, you can also go to ‘File’ > ‘Login to Trade account’ and the login box will appear.

If you have yet to download MT4 - first you’ll need to get your login number, password & access to the client portal (our server). Once you’ve opened an Equiti account, these details will be emailed to you & you’ll be able to download MT4 on your preferred device.

What happens to my positions if I logout of MT4?

Open positions will not be closed if you log out of MT4 until an existing stop loss, take profit or stop out level is reached. Always make sure to monitor your trades and be aware of financing fees if you’re rolling a position past trading hours.

Do you have a multi-terminal MT4?

Unfortunately, MetaQuotes has suspended this feature so it is no longer available on Equiti’s client portal.

Can I change the language on MT4?

Yes! On the top navigation bar, please select your language of choice from the ‘language’ option.

What time zone does MT4 operate on?

MT4 always coincides with the NY close.

During ‘daylight savings’ (27.03.2022 - 30.10.2022) it will operate on GMT+3, and in winter on GMT+2.

Can I change MT4’s time zone?

Unfortunately no, MT4 will always coincide with the NY close.

What price is shown on MT4?

The prices shown on the live charts & all history prices are the BID prices only. To see both the BID and the ASK prices check the Market Watch - which displays the symbols, prices and spreads depending on what you choose to add to the columns.

You can add the ASK line by right-clicking on the main body of the chart, click on ‘Properties' > 'Show ASK’ line. The ASK line will then appear showing you the current BUY (ASK) price.

Typical spreads can be seen on our Product pages, however these are an indicative and can vary during overnight hours and news releases.

How do I place a trade on MT4?

Open the order window on MetaTrader 4 and place a trade using any of the following methods:

- Right-click on a currency pair in the Market Watch window and select ‘New Trade’

- Right-click on an active chart and select ‘Trade’ > ‘New Order’

- Click on the 'New Order' button in the toolbar

- Press the ‘F9’ hot key on your keyboard

- Enable ‘One Click Trading’

Always remember to use appropriate risk management tools and ensure your trading account is appropriately funded for your margin requirements.

How do I place an order on MT4?

Once the Order Window has been opened, traders can enter information into fields and make selections from drop-down lists to prepare the trade order.

You must specify the following:

- Symbol from the drop-down list at the top (this will automatically be set to the symbol on the active chart). A corresponding tick chart appears in the left pane that displays current prices.

- Volume in terms of lot size. 1.0 is equal to 1 lot, or 100,000 units. You can also select to trade in smaller volumes, such as 0.1 or 0.01.

- Stop Loss and Take Profit to set a limit that you would like your trade to be closed at.

- Comment if desired. Traders can enter text in the Comment field that will be assigned to the order.

- Type either Market Execution (a market order) or Pending Order (a limit order; discussed more in the Pending Orders section) where the trader can specify the desired entry price.

After these fields have been specified:

- Click ‘Sell by Market’ or ‘Buy by Market’, depending on the desired trade direction, to place the trade.

- Click 'Okay' to close the window.

How do I select from ‘Pending Orders’?

If a Pending Order is selected, select the type of order from the drop-down menu. Available order types include:

- Buy Limit: Buy; provided the future "ask" price is equal to the pre-defined value & the current price level is higher than the value of the placed order. Orders of this type are usually placed when anticipating that the asset price will increase after having fallen to a certain level.

- Sell Limit: Sell; provided the future "bid" price is equal to the pre-defined value & the current price level is lower than the value of the placed order. Orders of this type are usually placed in anticipation of that the asset price, having increased to a certain level, will fall.

- Buy Stop: Buy; provided the future "ask" price is equal to the pre-defined value & the current price level is lower than the value of the placed order. Orders of this type are usually placed in anticipation of that the asset price, having reached a certain level, will keep on increasing.

- Sell Stop: Sell; provided the future "bid" price is equal to the pre-defined value & the current price level is higher than the value of the placed order. Orders of this type are usually placed in anticipation of that the asset price, having reached a certain level, will keep on falling.

Then specify the price at which the order will be triggered at by entering the value next to the ‘at price’ field.

To avoid manually entering the price, click on the up or down arrow next to the price field to fill in the current price, and then adjust as you deem necessary.

How can I close a trade?

- In the Terminal window, click on the trade tab and highlight your open position, double click on it and the new order window will appear.

- Click on the yellow button below 'Sell' and 'Buy' to close out a position.

- Right click on the highlighted order and select Close Order.

If one-click-trading is enabled, you can close a position in clicking on the ‘X' on the right hand side of the order line in the Terminal window.

Always remember to trade within your means, keep a close eye on your open trades and to use appropriate risk management tools like setting ‘Take Profit’ (which is similar to stop loss) to automatically trigger closing a position.

How can I see all available products on MT4?

To see all available products, right click ‘Market Watch’ and select ‘Show all’.

Can I use Expert Advisors & Autotraders on MT4?

Yes, MetaTrader 4 allows the use of 80+ technical tools including Expert Advisors and Autotraders.

How do l use EAs (Expert Advisors) on my MT4?

Equiti does not place any restrictions on third party indicators or Expert advisors as long as they’re compatible with the MT4 platform.

To start using EAs, please follow these steps:

- Go to ‘File‘ and select ‘Open Data Folder’ on the MT4 Platform.

- Go to ‘MQL4’ and open folder ‘Experts’.

- Transfer the EA files into the folder and close the MT4 trading platform.

- Once you open your trading platform again, the Expert Advisor will appear on your ‘Navigator’ list on the MT4 platform.

Can I use a Virtual Private Server (VPS)?

Yes, we allow third-party VPS providers to be used.

Can I download a statement from MT4?

Yes, you can. If you’d like to download a statement, please follow these steps:

- Open the platform and login with your Equiti account details.

- Select the ‘Account History’ tab in the terminal.

- Right click in the middle of the terminal and select 'custom period'.

- Select the start and finish date for the tax year you need and press ‘OK’. The history from the period selected will then fill the ‘Account History’ section.

- Right click again and select ‘Save Report’.

Product FAQs

What is forex & how do I trade FX pairs?

Forex (‘foreign exchange’ or ‘fx’) describes trading currencies in pairs, like EURUSD, on a decentralised over-the-counter global market. Each currency has an official abbreviation - in this case, EUR means ‘Euro’ & USD means ‘United States Dollar’. When trading forex, your bid price or ‘base currency’ is shown first (here as EUR) and is followed by the ask price or ‘quote currency’ (here as USD). The values of these currencies change quickly which is reflected in the spread, i.e. the difference between bid & ask price.

What forex pairs can I trade?

We offer over 60 major, minor & exotic fx pairs - including EURUSD spreads from 0.0 pips with 1:400 leverage on Premier accounts.

What are indices & how do I trade them?

A group or basket of stocks are called an ‘index’ or ‘indices’. Indices are a measurement of the value (and pricing) of a specific section of the stock market, which allow traders to speculate on entire sectors at once. Grouping selected stocks or assets into an index creates a cost-effective mechanism for trading on a sector’s performance - i.e. opening a single position to trade on the entire UK100 - which tracks the 100 largest companies on the London Stock Exchange (LSE).

You can also trade on forex indices likes ‘DXY’ which tracks the performance of USD weighted against major currencies from across the world.

See index CFDs

What rolling indices can I trade?

We offer commission-free rolling major & minor stock market indices from around the world including AUS200 (Australia roll), China50, EU50 (Europe roll), DE30 (Germany roll), FR40 (France roll), HK50 (Hong Kong roll), India50, JP225 (Japan roll), ES35 (Spain roll), UK100 (United Kingdom roll) and US rolls like US500, UT100 and US30.

See index CFDs

What are CFD shares & how do I trade them?

CFD share trading (otherwise known as ‘equities’ or ‘stock market trading’) means buying and selling CFDs on the shares of companies listed on the stock exchange to make a profit. Companies will list their shares to raise immediate funds, and traders purchase share CFDs to make a profit on the outcome of a company’s future - without directly owning the share. This gives traders the availability to speculate on price action without the responsibility of being a direct shareholder.

Share CFDs are available for a wide variety of industries— so you can tap into your knowledge of specific businesses or diversify your portfolio. We offer over 300 shares CFDs from the US, EU & UK – including major companies like Apple, Alphabet (Google), Meta (prev. Facebook), Disney, Airbnb, Bumble, LVMH, Ryanair and more.

See share CFDs

What are CFD commodities & how do I trade them?

Commodity (or ‘commodities’) CFD trading is possibly the oldest form of trading – especially futures. They allow you to trade on the performance of commodities instead of directly owning the assets.

This refers to buying, selling and trading on the performance of hard commodities that are mined (such as oil, gold & gas) and soft commodities that are harvested (such as coffee & sugar).

Commodities are commonly discussed in four groups: precious metals (gold, silver, platinum, copper), agriculture (coffee, cocoa), Energies (Brent Crude Oil, WTI oil, Natural Gas) and livestock (meat).

See commodity CFDs

What precious metal CFDs do you offer?

We offer CFDs on gold, silver, platinum, copper and more on our Commodities page. Precious metals such as gold and silver can be considered one of the first-ever traded commodities. Investors and traders generally view gold as a safe haven during economic, political or social uncertainty due to their relatively stable demand and the world’s limited supply.

See Precious Metal CFDs

How are our precious metals priced?

The unit of measure for precious metals is in troy ounces. Please refer to the market specification for precious metals to see the contract sizes for Gold, Silver and Platinum against the US dollar.

Check out our Contract Expiry Dates

When can I trade metals?

Precious metal markets open at (18:00:00 New York time (i.e., 22:00:00 GMT) and you can make trades on XAUUSD, XAGUSD, XPTUSD, XAUEUR and XAGEUR via our trading platforms from 10 seconds after markets open at 18:00:10 NY time (22:00:10 GMT). This is because market participants are often 'guessing' where the price should be in the first few seconds, and some will quote wildly wide prices, while others will chose to wait for someone else to start pricing before they do. Generally, this price discovery process calms down within a few seconds. 10 seconds after the open, our systems can accurately aggregate prices from multiple reputable sources, cross-reference the pricing, and eliminate any potential discrepancies, ensuring that you have the most precise price to base your decisions on.

Our platform invests in cutting-edge technology and data verification methods to provide traders with the most precise and trustworthy pricing information available in real-time. Opening trading from 18:00:10 NY time (22:00:10 GMT) also ensures that even in the busiest or most volatile trading scenarios, all traders receive the most accurate and fair pricing information possible, maintaining market integrity.

What does ‘rolling commodities’ mean?

A ‘rolling’ option or ‘roll yield’ is type of return in commodities investing that involves the practice of exiting the current position and immediately entering a similar position in the next contract. This allows for traders to take advantage of the difference in the price of shorter-dated commodities, which are closer to maturity commodity contracts and their longer-dated counterparts.

What are CFD futures & how do I trade them?

Trade future CFDs to speculate or hedge on the price direction of a security, a commodity or other financial instruments. By purchasing a futures contract, parties agree to buy or sell an asset at a predetermined price at a specified time in the future - regardless of the current market price at the expiration date.

Especially in commodities, this allows traders to hedge against external conditions (like weather) that can impact crops. This means a farmer can set coffee prices upfront in case market prices fall at harvest time - and the buyer could lock in prices in case they soar when crops are delivered.

See indices & commodity future CFDs

What are CFD ETFs & how do I trade them?

An Exchange Traded Fund (or ‘ETF’) is a type of financial instrument describing a basket of securities composed of stocks selected by a professional Asset Manager. This ‘basket’ is traded just like a regular stock and can be bought directly of an exchange or traded on live markets. CFD ETFs are designed to track the performance of an underlying list of securities by grouping diversified products by design. This allows traders to easily trade on sectors (like robotics) with exposure to more than one security from a single position without having to own the underlying asset.

Check out our CFD ETFs selected by BlackRock - the world’s largest asset management company.

Partnerships FAQS

What partnership programs do you offer?

We offer tiered Asset Manager (AM) and Introducing Broker (IB) partnership programs.

Become an Equiti Partner

How will you know that a client signed up through me?

Once you open a partner account, you will receive an IB link that you can give your leads. When clients sign up for a Demo/live account, they will be automatically linked to your IB/AM profile.

What payment structures do you offer partners?

We offer tiered payment structures bespoke to individual partners and their needs. Please speak to one of our dedicated account managers for more detail.

Do you offer Multi Account Management (MAM) programs?

Yes, any Asset Manager can create his/her own MAM program. Clients can join this program after signing a limited power of attorney and allow the AM to trade on their behalf. This can be done through the client’s portal. The AM is then only authorised to trade on behalf of the client. The client is always in full control of his funds and can join or leave the MAM program at his own discretion.

How can I make profit from the MAM program?

An Asset manager can impose performance fees and management fees on the MAM program which the clients would need to agree to prior to joining the program.

So how does a MAM program work? How are profits and losses distributed?

MAM programs depend on the percentage of a client’s investment of the total amount of funds available in the MAM account and trades are distributed by equity percentage.

Example: Clients X, Y and Z join the MAM program for the asset manager A. Client X deposits $200, client Y deposits $700 and client Z deposits $100, bringing the total funds on the MAM program to $1000.

Each client’s percentage of the total funds is as follows:

Client X: 20%

Client Y: 70%

Client Z: 10%

If the AM opens a position of the currency pair EURUSD, with the volume of 0.50 lots. The margin, profit, loss, swaps, and commissions will be split between all 3 clients, depending on the percentage of the investment.

Client X will take 0.10 lots, Client Y will take 0.35 lots and Client Z will take 0.05 lots.

Client X will take 20% of profits/losses, Client Y will take 70% of profits/losses, and Client Z will take 10% of profits/losses.

What happens if a client gets stopped out in the MAM program or if (s)he decides to leave?

If a client gets stopped out or decides to leave, their share of the positions will be automatically closed and they will be automatically detached from the MAM program. The open positions of the remaining clients will remain open at the same price, but might have different ticket numbers.

In the case where the positions of the client being stopped out is less than the minimum trade of 0.01, then the remaining client’s positions might be affected by the combined volume of 0.01 lot for all.

When will I get my rebate/commission?

Rebates & commission schemes may vary depending on the individual IB or AM. Typically, half the payment is received when a position is opened and the other half will be paid when the position is closed. Rebates/Commissions are normally reflected onto your rebate account at the end of the trading session (00:00 platform timing).

There's more to explore

Platforms

Find the right trading platform for your needs - we offer MT4 and MT5.