Unlock your capital with CFD trading on global markets

Capture opportunities as markets move by speculating on indices, forex, commodities, ETFs, futures, shares & crypto CFDs.

Explore the world of CFD trading products

CFD or contract for difference is an agreement between a trader and a broker to transfer the difference in the value of a financial asset between the time the contract opens and closes. CFD trading is the buying and selling of CFDs based on the speculation of whether the price of the underlying asset, like a stock, will go up or down.

Trade CFDs on the world’s popular markets

Speculate on whether an asset's price will move up or down - without owning the asset.

Low costs

No sign up fees, low-to-zero commission and tight spreads from 0.0 pips*.

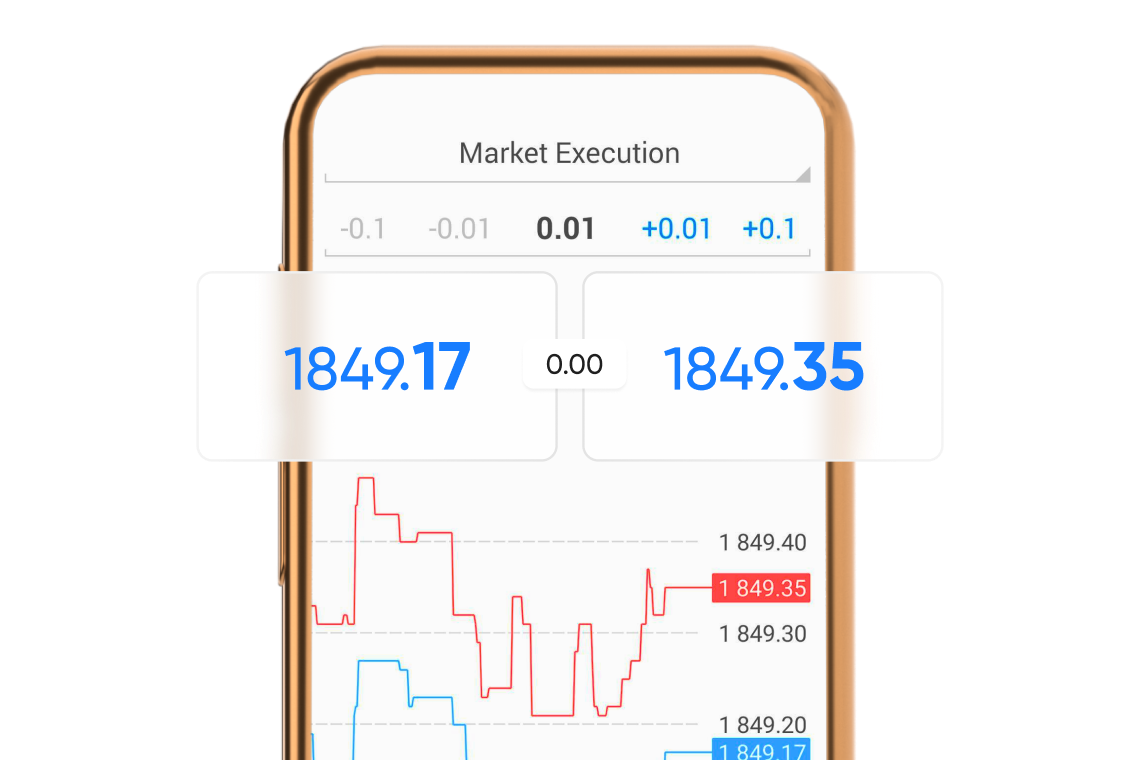

Fast execution

Top tech with low latency to keep your trades running as planned.

Secure

Your money is kept in independent accounts with trusted Tier 1 banks.

Spot an opportunity, then seize it

Trillions move in the market daily, we've handpicked these CFD trading instruments to give you a head start.

1,500+ shares

Trade on the yield of top companies like Apple, Meta, Disney, LVMH & Tesla.

Commodities

Weigh in on the performance of oil, gold, silver, coffee & more with lots from 0.01*.

Frequently asked questions

What are Contracts for Difference (CFDs)?

Contracts for Difference (CFDs) are derivative financial products that allow you to trade on the price movements of underlying assets without owning them. This gives you the ability to open buy positions to benefit from rising markets or sell positions to benefit from falling ones.

For example:

- When you buy a CFD, you’re speculating that the asset’s value will rise and you profit from the difference between the buying price and the selling price when you close the trade.

- When you sell a CFD, you’re speculating that the price will fall and you profit from the difference between the selling price and the buying price.

With Equiti, you can trade a wide range of CFDs including currency pairs, shares, exchange-traded funds (ETFs), futures, commodities, cryptocurrencies and global indices such as US500, UK100, AUS200, China50 and Sing30.

How can I start trading CFDs?

To start trading CFDs, you first need to open a trading account with a trusted broker like Equiti. Then, fund your account and choose the asset you want to trade. You can open buy positions if you expect the price to rise or sell positions if you expect it to fall. Don’t forget to use risk management tools such as stop-loss orders to protect your funds.

Start trading CFDs

What is leverage?

Leverage is a tool that allows you to increase the size of your trades using margin. In other words, you can hold larger positions than your actual deposit by borrowing funds from a liquidity pool. For example, a leverage ratio of 1:20 means that a $10 deposit lets you trade with $200, increasing both your profit potential and your risk exposure.

How do I use leverage?

You can use leverage to increase your market exposure, but it’s crucial to manage risk carefully using tools such as stop-loss orders and capital management strategies. Equiti offers leverage up to 500:1 on selected products including precious metals, gold, oil, natural gas and commodity CFDs, giving you greater flexibility and wider trading opportunities.

What is a “pip”?

A pip (short for “percentage in point”) is a very small unit that measures the change in the value of a currency pair in the forex market. It’s the standard unit for the smallest possible change in an exchange rate, typically 0.0001 USD for pairs quoted against the US dollar. A fractional pip equals 1/10 of a pip, meaning 10 fractional pips equal one standard pip.

What are spreads?

Spreads are measured in pips and represent the difference between the buy and sell price of an asset. In trading, the ask price (or offer price) is the price you’re willing to buy at, while the bid price is the price you’re willing to sell at. For example, if the bid price for EUR/USD is 1.55310 and the ask price is 1.55313, the spread would be 0.3 pips.

Does Equiti offer margin-free hedging?

Yes, you can use margin-free hedging. If your net position equals zero no additional margin is required.

This allows you to use more of your available funds for trading, however, it may expose you to risks such as margin calls or automatic closures if spreads widen suddenly, especially during major economic announcements. It’s also important to note that margin-free hedging positions do not exempt you from overnight financing fees, unless you are trading through a swap-free account.

Check our financing fees

Explore more with Equiti

Platforms

Find the right trading platform for your needs - we offer MT4 and MT5.