Global forex trading with tight spreads

Access online forex trading platforms to leverage major, minor and exotic pairs like GBPUSD from 1:500 with spreads from 0.0 pips*.

Explore online forex trading

Forex CFD trading involves the buying and selling of currency pairs, where traders speculate on the fluctuating exchange rates between two currencies. The goal of forex trading is to profit from these price movements by buying a currency pair at a lower price and selling it at a higher price, or vice versa. You can trade in the forex market 24 hours a day, 5 days a week.

Trade major, minor & exotic FX pairs on global exchanges

Get ahead of international currency and interest rate risk - speculate on geopolitical events and diversify your portfolio.

60+ FX pairs

Spot opportunity anywhere with major, minor & exotic pairs from around the world.

Leverage up to 1:500

Expand your trading position with competitive leverage on selected products.

Low costs

No sign up fees, low-to-zero commission and tight spreads from 0.0 pips*.

| Column 1 | Column 2 | Column 3 |

|---|---|---|

| n/a | n/a | n/a |

| n/a | n/a | n/a |

| n/a | n/a | n/a |

| n/a | n/a | n/a |

| n/a | n/a | n/a |

The margins below only apply to MT4. We’ve introduced tiered margins on MT5. To learn more, see our Tiered Margins on MT5.

|

Currency Pair |

Minor/Major |

Typical Spread (pips)* on our Premier account |

Typical Spread (pips)* on our Standard account |

Fixed Leverage | Margin |

|---|---|---|---|---|---|

| AUDCAD | Minor | 1.1 | 2.6 | 1:500 | 0.20% |

| AUDCHF | Minor | 0.8 | 2.2 | 1:100 | 1.00% |

| AUDJPY | Minor | 1 | 2.3 | 1:500 | 0.20% |

| AUDNZD | Minor | 1.1 | 2.9 | 1:500 | 0.20% |

| AUDSGD | Exotic | 1.5 | 6.3 | 1:50 | 2.00% |

| AUDUSD | Major | 0.1 | 1.5 | 1:500 | 0.20% |

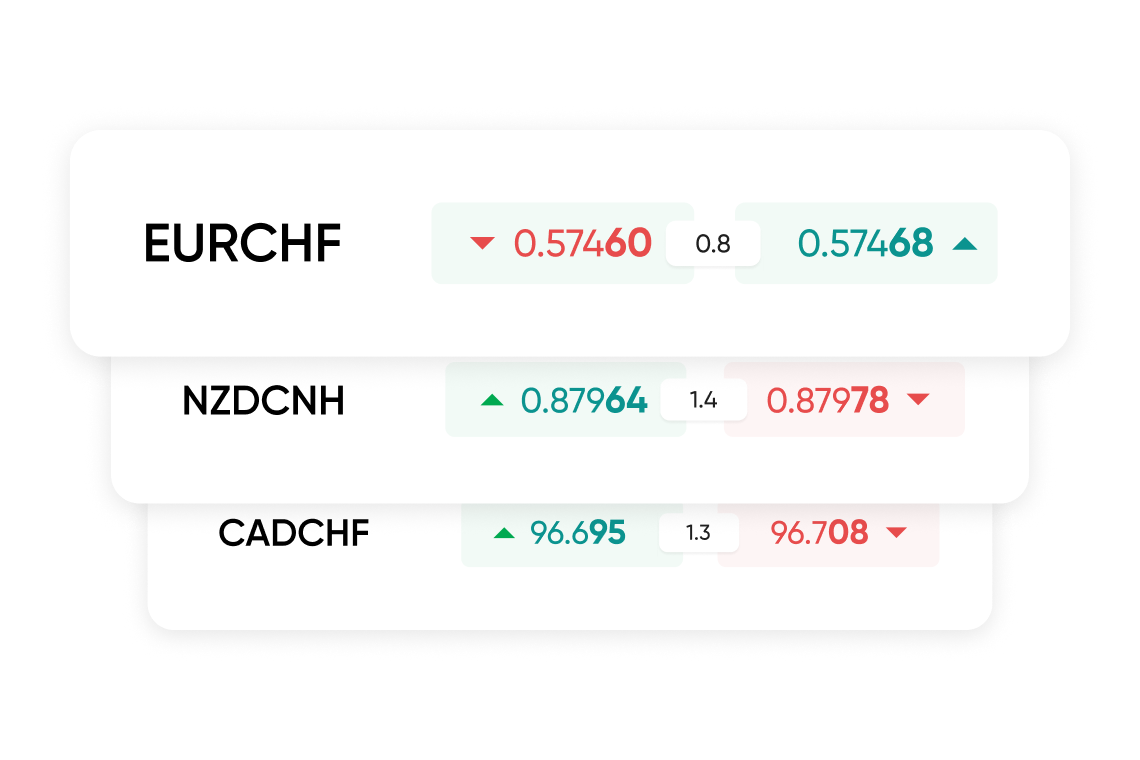

| CADCHF | Minor | 1.3 | 2.7 | 1:100 | 1.00% |

| CADJPY | Minor | 1.2 | 2.4 | 1:500 | 0.20% |

| CADSGD | Exotic | 2 | 6.8 | 1:50 | 2.00% |

| CHFJPY | Minor | 1 | 3.2 | 1:100 | 1.00% |

| CHFSGD | Exotic | 2.6 | 7.3 | 1:100 | 1.00% |

| EURAUD | Minor | 1.3 | 2.5 | 1:500 | 0.20% |

| EURCAD | Minor | 0.7 | 3.4 | 1:500 | 0.20% |

| EURCHF | Major | 0.7 | 2.7 | 1:100 | 1.00% |

| EURGBP | Major | 0.2 | 2 | 1:500 | 0.20% |

| EURJPY | Major | 0.5 | 2.2 | 1:500 | 0.20% |

| EURMXN | Exotic | 142.3 | 82.3 | 1:50 | 2.00% |

| EURNOK | Exotic | 72.8 | 145.3 | 1:50 | 2.00% |

| EURNZD | Minor | 1.7 | 3.2 | 1:500 | 0.20% |

| EURPLN | Exotic | 23.3 | 26.1 | 1:50 | 2.00% |

| EURSEK | Exotic | 42.5 | 75.3 | 1:50 | 2.00% |

| EURSGD | Exotic | 1.8 | 3.8 | 1:50 | 2.00% |

| EURUSD | Major | 0 | 1.4 | 1:500 | 0.20% |

| EURZAR | Exotic | 63.1 | 63.1 | 1:50 | 2.00% |

| GBPAUD | Minor | 1.7 | 5.5 | 1:500 | 0.20% |

| GBPCAD | Minor | 1.7 | 5.1 | 1:500 | 0.20% |

| GBPCHF | Major | 1.2 | 3.8 | 1:100 | 1.00% |

| GBPJPY | Major | 0.7 | 2.5 | 1:500 | 0.20% |

| GBPNOK | Exotic | 118.5 | 148.4 | 1:50 | 2.00% |

| GBPNZD | Minor | 2.3 | 5.2 | 1:500 | 0.20% |

| GBPSEK | Exotic | 70.7 | 85.3 | 1:50 | 2.00% |

| GBPSGD | Exotic | 2.4 | 4.8 | 1:50 | 2.00% |

| GBPUSD | Major | 0.2 | 2.2 | 1:500 | 0.20% |

| GBPZAR | Exotic | 63.2 | 63.2 | 1:50 | 2.00% |

| MXNJPY | Exotic | 1.1 | 1.3 | 1:50 | 2.00% |

| NOKJPY | Exotic | 22.2 | 22.4 | 1:50 | 2.00% |

| NOKSEK | Exotic | 25.5 | 28.1 | 1:50 | 2.00% |

| NZDCAD | Minor | 1.1 | 3.1 | 1:500 | 0.20% |

| NZDCHF | Minor | 1.1 | 4.6 | 1:100 | 1.00% |

| NZDJPY | Minor | 1.1 | 2.5 | 1:500 | 0.20% |

| NZDSGD | Exotic | 2 | 3.2 | 1:50 | 2.00% |

| NZDUSD | Major | 0.4 | 2 | 1:500 | 0.20% |

| SEKJPY | Exotic | 20.2 | 20.4 | 1:50 | 2.00% |

| SGDJPY | Exotic | 1.3 | 2.7 | 1:50 | 2.00% |

| USDCAD | Major | 0.4 | 2 | 1:500 | 0.20% |

| USDCHF | Major | 0.3 | 2 | 1:100 | 1.00% |

| USDCNH | Exotic | 12.4 | 22.9 | 1:50 | 2.00% |

| USDJPY | Major | 0 | 1.4 | 1:500 | 0.20% |

| USDMXN | Exotic | 120.3 | 60.3 | 1:50 | 2.00% |

| USDNOK | Exotic | 108.2 | 121.3 | 1:50 | 2.00% |

| USDPLN | Exotic | 8.8 | 26 | 1:50 | 2.00% |

| USDSEK | Exotic | 33.1 | 72.5 | 1:50 | 2.00% |

| USDSGD | Exotic | 1.2 | 3.1 | 1:50 | 2.00% |

| USDZAR | Exotic | 71.1 | 140.9 | 1:50 | 2.00% |

Trade rolling FX Futures

Seek potential as prices rise and fall on our swap-free forex futures that don’t expire.

Forex futures

Trade our swap-free rolling forex futures with fixed spreads and no expiry dates.

Rolling FX Futures

| Symbol | From (lots) | To (lots) | Tier 1 Margin | Tier 1 Leverage | From (lots) | To (lots) | Tier 2 Margin | Tier 2 Leverage | From (lots) | To (lots) | Tier 3 Margin | Tier 3 Leverage | From (lots) | To (lots) | Tier 4 Margin | Tier 4 Leverage | From (lots) | To (lots) | Tier 5 Margin | Tier 5 Leverage |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EURUSDfuture | 0 | 100 | 0.20% | 500 | 100 | 200 | 0.50% | 200 | 200 | 300 | 1% | 100 | 300 | over | 3% | 33 | - | - | - | - |

| GBPUSDfuture | 0 | 100 | 0.20% | 500 | 100 | 200 | 0.50% | 200 | 200 | 300 | 1% | 100 | 300 | over | 3% | 33 | - | - | - | - |

| EURGBPfuture | 0 | 100 | 0.20% | 500 | 100 | 200 | 0.50% | 200 | 200 | 300 | 1% | 100 | 300 | over | 3% | 33 | - | - | - | - |

FX trading hours

Please note that liquidity and spreads can change due to market conditions, spreads are variable and can widen overnight. The information in these tables is correct at the time of publication, we reserve the right to change the content at any time. For live updates, please refer to your trading platform or contact our Support teams.

Rolling FX hours

Sun: 17:01-24:00 NY time

Mon-Thu: 00:00 - 16:59 and 17:05-24:00 NY time

Fri: 00:00-16:57 NY time

Rolling FX Futures hours

Sun: 18:01-24:00 NY time

Mon-Thu: 00:00 - 16:59 and 18:01 - 24:00 NY time

Fri: 00:00 - 15:59 NY time

Please note that USDRUB is set to close only and is not available for trading at any of the times listed above.

*Average prices are during London and New York sessions.

**Trading hours can change due to public holidays. Please check our Holiday Hours page for upcoming closures.

Frequently asked questions

What is forex trading?

Forex, short for Foreign Exchange, is a global decentralised market where currencies are traded. It’s the world’s largest and most liquid financial market, with trillions of dollars traded daily. Forex traders exchange one currency for another to speculate on price movements, hedge against risk, or facilitate international trade and investment opportunities. Forex is also referred to as FX, currencies or currency pair trading.

How do I trade currency pairs in forex?

To trade currency pairs, you first need to understand that every forex transaction involves buying one currency and selling another at the same time, represented as a currency pair, such as EUR/USD (Euro vs US Dollar). The goal of forex trading is to profit from fluctuations in exchange rates between the two currencies. The forex market moves based on several key factors, including geopolitical events, economic data and indicators, central bank policies, market sentiment and confidence.

Each currency has an official three-letter code, such as EUR = Euro, USD = US Dollar. In a pair like EUR/USD, EUR is the base currency and USD is the quote currency. The price tells you how many US dollars are needed to buy one euro. One of the main advantages of Forex is that it’s open 24 hours a day, five days a week, thanks to multiple global financial centres operating across different time zones, offering traders continuous opportunities around the clock.

Which currency pairs can I trade?

With Equiti, you can trade over 60 currency pairs, including major, minor and exotic FX pairs. You can also trade EUR/USD with spreads starting from 0.0 pips and leverage up to 1:500 through a Premier account.

See all accounts

When does the forex market open?

The forex market operates 24 hours a day, starting on Sunday at 5pm New York time and closing on Friday at 5pm. This continuous schedule is made possible by major financial hubs located across various time zones worldwide.

What is leverage in forex trading?

Leverage allows you to trade using borrowed funds, enabling you to open larger positions than your actual account balance, amplifying both potential profits and losses. Equiti provides leverage through a margin-based system, allowing you to access the market with a smaller initial deposit. For example, with a 1:20 leverage ratio, every $10 of your own funds lets you trade with $200 in market exposure.

Caution: While leverage can increase your profit potential, it also magnifies losses if the market moves against you. Always understand your risk tolerance and use risk management tools such as stop-loss orders to protect your capital.

What is a pip in forex trading?

A pip (short for percentage in point) is a very small unit used to measure changes in the price of a currency pair. It represents the smallest price movement a currency pair can make, either in the quoted or base currency. For example, if EUR/USD moves from 1.1000 to 1.1050, the price has risen by 50 pips. In most USD-based currency pairs, one pip equals 0.0001. There’s also a fractional pip (pipette), which equals 1/10 of a pip, meaning 10 pipettes = 1 pip.

What is a swap in forex trading?

A swap is a fee or interest charged when an FX trading position is left open overnight. It represents the interest rate differential between the two currencies in a traded pair.

What are forex spreads?

In forex trading, the spread is the difference between the buy (ask) price and the sell (bid) price of a currency pair, measured in pips. For example: If the bid price for EUR/USD is 1.55310 and the ask price is 1.55313, the spread equals 0.3 pips.

Explore more with Equiti

Platforms

Find the right trading platform for your needs - we offer MT4 and MT5.